Ben Shalom Bernanke was born on December 13, 1953, in Augusta, Georgia, and raised in South Carolina. At 12 years old, Bernanke won the South Carolina state spelling bee, despite being initially told that he had misspelled a word. Bernanke, certain he was right, left the stage anyway. “He came back on stage and said he had spelled it correctly,” his mother Edna recalled to the Washington Post. “And he was right.” Bernanke was later eliminated at the national bee when he misspelled the word edelweiss. He taught himself calculus in high school because his school did not offer the course. He went on to score a 1590 out of 1600 on his SAT. Bernanke also played the alto saxophone. He earned a B.A. in economics from Harvard University in 1975. He was given the distinction of having the best undergraduate economics thesis and was named outstanding senior in the economics department. In 1979, Bernanke received his economics PhD from MIT and began teaching at Stanford University’s Graduate School of Business. Six years later he joined the Princeton faculty as professor of economics and public affairs. In 1996, he was named chairman of Princeton’s economics department. Before arriving at Princeton, Dr. Bernanke was an Associate Professor of Economics (1983-85) and an Assistant Professor of Economics (1979-83) at the Graduate School of Business at Stanford University. His teaching career also included serving as a Visiting Professor of Economics at New York University (1993) and at the Massachusetts Institute of Technology (1989-90). Dr. Bernanke has published many articles on a wide variety of economic issues, including monetary policy and macroeconomics, and he is the author of several scholarly books and two textbooks. He has held a Guggenheim Fellowship and a Sloan Fellowship, and he is a Fellow of the Econometric Society and of the American Academy of Arts and Sciences. Dr. Bernanke served as the Director of the Monetary Economics Program of the National Bureau of Economic Research (NBER) and as a member of the NBER’s Business Cycle Dating Committee. In July 2001, he was appointed Editor of the American Economic Review. Dr. Bernanke’s work with civic and professional groups includes having served two terms as a member of the Montgomery Township (N.J.) Board of Education, a position that he cites as being formative to his policy-making experience. Dr. Bernanke became a governor of the Federal Reserve in 2002, taking leave from his position at Princeton. Before his appointment as Chairman, Dr. Bernanke was Chairman of the President’s Council of Economic Advisers, from June 2005 to January 2006. Dr. Bernanke has already served the Federal Reserve System in several roles. He was a member of the Board of Governors of the Federal Reserve System from 2002 to 2005; a visiting scholar at the Federal Reserve Banks of Philadelphia (1987-89), Boston (1989-90), and New York (1990-91, 1994-96); and a member of the Academic Advisory Panel at the Federal Reserve Bank of New York (1990-2002). Ben S. Bernanke began a second term as Chairman of the Board of Governors of the Federal Reserve System on February 1, 2010. Dr. Bernanke also serves as Chairman of the Federal Open Market Committee, the System’s principal monetary policymaking body. He originally took office as Chairman on February 1, 2006, when he also began a 14-year term as a member of the Board. His second term as Chairman ends January 31, 2014, and his term as a Board member ends January 31, 2020. Bernanke and his wife Anna married on May 29, 1978. They have two children.

Ben S. Bernanke was appointed Chairman of the Board of Governors of the Federal Reserve System in 2006, replacing Alan Greenspan. Congress appointed Bernanke for his knowledge of how monetary policy contributed to the Great Depression and his belief in inflation targeting. He created many innovative tools to prevent a global depression during the credit crisis. He led the Federal Reserve in taking on new roles, such as bailing out Bear Stearns and the $150 billion bailout of insurance giant AIG. The Fed loaned $540 billion to money market funds to stop a global panic. Under Bernanke, the Federal Reserve made very creative use of its tools. Prior Chairmen used only the Federal funds rate, raising it to stem inflation or lowering it to prevent recession. Between September 2007 and December 2008, Bernanke decisively lowered the rate 10 times, from 5.25% to 0%. But this wasn’t enough to restore liquidity to banks panicked by defaulting subprime mortgages. These loans had been repackaged and sold them in mortgage-backed securities that were so complicated that no one really understood who had the bad debt. As a result, banks stopped short-term lending, which was routinely done as a way to meet the Federal Reserve requirement. In response, Bernanke relaxed the requirements, lowered the discount rate, and finally provided credit itself through the discount window. When this wasn’t enough, Bernanke created the Term Auction Facility in December 2007. The TAF lent billions to banks, taking on bad debt as collateral. The TAF was meant to be temporary, until the banks marked down the bad debt and started lending to each other again. When this didn’t happen, the TAF grew larger, reaching a peak of $1 trillion by June 2008. Bernanke worked with central bankers around the world to restore liquidity when credit markets froze. He added $180 billion in dollar credit swap lines. These are agreements to keep a supply of dollars available to trade to other central banks for overnight and short-term lending. It was necessary because panicked banks were hoarding cash. They were afraid to lend to each other because they didn’t want to get stuck with derivatives based on sub-prime mortgages.

The following link, Obama to Nominate Bernanke to 2nd Term at Fed, will give the information into what the top White House officials as well as the President have to say about Ben Bernanke and the job that he has done as the Chairman of the Fed.

The following link, Bernanke warns of “Fiscal Cliff” danger, is a speech Dr. Bernanke gives to the Economic Club Of New York on the dangers of the “Fiscal Cliff”.

The following link, 60 minutes interview with Ben Bernanke, is an exclusive interview with Chairman Bernanke on pressing economic issues, including unemployment, the deficit and the Fed’s controversial $600 billion U.S. Treasury Bill purchase.

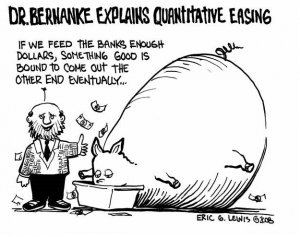

The following link, Quantitive easing, is a humorous video explaining Quantitive Easing on You Tube.

In closing, Federal Reserve chairman Ben Bernanke announced that the Fed would launch a third round of so-called quantitative easing, or QE3 — an aggressive bond-buying program designed to lower long-term interest rates in the hopes of stimulating economic activity and reducing unemployment. The Fed said it will spend $40 billion a month purchasing mortgage debt through the end of the year, and left open the possibility of continuing the program until conditions improve. Additionally, it will continue its bond purchases as well as push back its deadline for raising short-term interest rates from 2014 to 2015 — another way the Fed’s attempted to spur growth through more borrowing and spending.

Sources:

http://www.time.com/time/business/article

Huffington Post

New York Times

You Tube

CBS 60 minutes

Download this page in PDF format

Download this page in PDF format