In 2008, the United States saw the worst housing crisis in its history. In the years leading up to the crisis the US saw housing prices skyrocket to 30-40% growth in a year. Mortgages were easy to acquire, predatory lending was abundant, and subprime loans were commonplace. Homebuyers were refinancing their homes at record rates, homes were being bought and flipped at enormous profits, and banks were seeing higher than normal profits. The events that were taking place were unbelievable and unsustainable. The purpose of this article is to take a look at housing through the centuries from the 1600’s to present day with a focus on what houses looked like and the mortgage industry. It will also cover how the housing industry changed significantly in the 1900’s to where it is today.

Housing in the 1600’s

Houses in the 1600’s were made by hand using materials that were brought over by the first setters or using the timber that was available in the woods. Oak was the prevalent wood and was used most often. A home was basic, one story with two rooms with a chimney running up the middle. By the end of the century homes had evolved to a two story four room structure. The homes took on a Colonial design as seen below:

Since materials were used from what was available on the land, there was no need for a mortgage and since banks weren’t in existence, they weren’t available. (http://www.takus.com/architecture/1colonial.html)

Housing in the 1700’s

Homes in the 1700’s were still made in the same fashion as they were in the 1600’s. Settlers used available timber or mud. There were two predominant home types: mud houses with thatched roofs and one room and wood houses with steep roofs. Most were a single story although the wealthier settlers had two story homes. Mortgages still weren’t in existence. (http://www.ehow.com/info_8481569_kind-homes-did-puritans-live.html)

Housing in the 1800’s

The 1800’s brought many changes to the housing industry. There was lots of land for sale although there were few buyers. The price of land was dramatically lowered for people to purchase it…an acre of land averaged 12.5 cents and was sold by the government. People settled near waterways in isolated farms or small hamlets. (http://www.watersheds.org/history/earlysettlers.htm). Home materials began to change based on regions and ethnic backgrounds. Wood was most often used in the New England area while the southern regions used brick. In the West, log homes were more prevalent. The exteriors were typically faded and unkept and dirt in the home was often ignored. The wealthy did paint their homes. (http://www.historycentral.com/NN/America/Homes.html) Materials were gathered from local vendors or nature and paid using currency. The central banking system was still in infancy and mortgages still did not exist.

Housing in the early 1900’s

The 20th Century brought great changes in the housing industry and began to set the standards for the industry today. As we entered the 20th century, foundations were placed on the ground, homes were modest (less than 1,000 square feet) with 2-3 bedrooms. Indoor plumbing and electricity was still uncommon. Builders began using the braced framing method for increased stability. As time went on, materials began to change based on economic status. Builders began using concrete footings or reinforced cement foundations. The quality of the homes and materials were heavily dependent upon ability to pay. Most homes were paid for in cash. (http://www.ehow.com/info_8701082_way-houses-were-made-1900s.html)

Housing in the mid 1900’s

Houses in the mid 1900’s began being built with standardized building materials and methods. They were becoming larger with the average square footage being close to 1,000. Most had bathrooms, 2 bedrooms, and over 50% had garages. The cost of homes began to rise with an average home costing around $11,000. Due to the high cost of homes, most people had to borrow money and the mortgage was created. Terms were short, 3-5 years at the maximum. Large down payments were required and the interest rate was high.

In 1934, the National Housing Act was passed to help stimulate the release of credit to banks to allow for home repairs and construction. The act created the Federal Housing Administration (FHA) and one of its purposes was to handle mortgage insurance. Because the FHA assumed the risk, banks were able to extend the terms of mortgage loans making it easier for borrowers to repay the loan. Another result of the FHA was the creation of Fannie Mae, and it was a national mortgage association that allowed for a market in which mortgages could be sold.

There were many Acts and agencies created in the decades that followed. They put in place standards of building codes, low income housing programs, neighborhood revitalization programs, elderly and disabled preferences for housing, and equal opportunity for all persons regardless of race. In 1965, the Housing and Urban Development Act created HUD (Housing and Urban Development) to administer the low-income housing programs. (http://www.huduser.org/Publications/PDF/review.pdf, http://www.ehow.com/info_8701082_way-houses-were-made-1900s.html, http://www.hud.gov/offices/adm/about/admguide/history.cfm)

Housing in the late 1900’s to present

In the late 1970’s, HUD created a program called Section 8. The program was developed to help low income families afford housing. It set housing quality standards and affordability standards for what people should pay for their housing each month. The affordability standard was 30 % of monthly gross income should go toward housing and no more than that. In turn, HUD would pay 70% of the monthly rent. The Section 8 program is still in place and the 30% standard is still the industry norm. http://www.hud.gov/offices/adm/about/admguide/history.cfm

The late 1900’s to present watched homes continue to grow in size and cost. The average cost of a home was now almost $200,000 and was over 2,000 square foot. 2 car garages became the norm and 2 or more bathrooms were standard. Bedrooms went from 2 to more commonly 3 or more. We saw a shift in materials being used as well. Granite and Quartz along with premium wood and bamboo. The green energy movement has transformed the material production and how we build. Windows are super-efficient, garage doors are insulated, and geo-thermal heating and cooling systems are more commonplace. Furnaces are purchased by their efficiency ratings and soon an 80% efficient furnace will no longer be available for purchase.

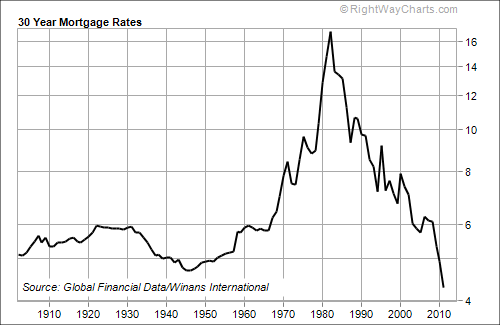

Mortgage rates during this period fluctuated wildly. As you can see below, the 30 year rates have been fairly stable until the 80’s and have begun dropping drastically by 2010.

Currently, we are seeing the lowest mortgage rates in history. At their highest, it was over 16% for a 30 year loan. Today, a 3% rate for a 30 year loan is the norm. (http://www.dailywealth.com/1615/The-Best-Time-in-History-to-Buy-a-House)

To see other interesting graphs showing home prices and affordability indexes, please go to http://www.dailywealth.com/1615/The-Best-Time-in-History-to-Buy-a-House.

The Housing Bubble

The housing bubble that hit the United States affected many parts of the country with some areas hit worse than others. Home prices peaked in 2006, with a steady decline beginning in late 2006 until 2012. Home prices are still declining in some areas however, most have begun stabilizing. The collapse of the bubble impacts many areas including but not limited to home values, real estate, home builders, home supply companies and Wall Street. Due to the collapse and the amount of homeowners that were unable to pay their mortgage debts, the government offered a limited bailout to those people. Over 1 trillion dollars has been given by the government to rescue homeowners and lending intuitions, including Freddie Mac, Fannie Mae, and FHA. (http://en.wikipedia.org/wiki/United_States_housing_bubble)

Housing bubbles are hard to predict and often times they are only seen in hindsight. Land prices begin to increase and soon that leads to higher prices than the actual structure. In the late stages of the bubble, home prices begin to see rapid increases at unsustainable levels relative to incomes, price to rent ratios, and other affordability indicators. This period is then followed by decreasing home values with many home owners in a negative equity situation (the home is worth less than the mortgage note). One of the casualties of the bubble is the mortgage and credit crisis that followed once homeowners could no longer pay the mortgage after the introductory rate mortgage interest rates went back to a regular interest rate. Some of these mortgages were interest only rates, balloon rates, or short term mortgage terms with a refinance deadline (Adjustable Rate Mortgage loans). Often times home buyers were above the 30% housing affordability factor set in place by HUD. Some were borrowing 40-50% of their gross monthly income! (http://en.wikipedia.org/wiki/United_States_housing_bubble)

Although housing bubbles are hard to predict, some analysts began seeing economic and cultural factors as early as 2004. Market data studies conducted in 2006 showed a market decline including lower sales, falling prices and an increase in foreclosures. Economists believe the bubble burst beginning in 2006. In March 2007, home sales and prices saw its steepest plunge since the Savings and Loan Crisis in 1989. (http://en.wikipedia.org/wiki/United_States_housing_bubble)

There were side effects of the Housing Bubble. The most prevalent effect was the increase of new home construction. Refinancing grew increasingly popular with homeowners taking advantage of increasing home values to pay off credit card debit, remodel, or for personal use. Another effect was the shift of people living in large metropolitan areas to the suburbs due to high prices. (http://en.wikipedia.org/wiki/United_States_housing_bubble)

Causes of the Housing Bubble

The housing tax policy has had many changes sine 1978. The Taxpayer Relief Act of 1997 repealed the previous capital gain rules on homes and replaced it with a $500,000 (married) or $250,000 (single) exclusion on capital gains on the sale of a home once every two years. The Act made housing the only investment no subject to capital gains.

Deregulation of the banking industry also contributed by allowing more risky mortgage products to exist such as Adjustable Rate Mortgages (ARMs) and interest only loans.

Low mortgage rates after the dot-com bubble made easy credit for new loans. As interest rates began to rise, the ARM payments began to rise as did foreclosures, dropping home prices and values.

The desire for home ownership was also a contributing factor. There are several beliefs regarding home ownership such as homes do not fall in value (unlike the stock market) and that homes will yield average to better than average returns as investments. This theory is unfounded because historically the inflation adjusted house prices have increased less than 1% per year.

The media also promoted home ownership as an investment due to the large amount of shows depicting how to buy real estate low, remodel the home, and resell it high (also know as “flipping”).

Another factor that may have contributed was the crash of the dot-com bubble. Investors began buying real estate as a perceived safer more lucrative investment. The historically low interest rates also contributed. However, interest rates began to increase and hence the inability to pay higher mortgages. The use of risky loan products exasperated this problem.

This reference is for all of the Causes of the bubble (http://en.wikipedia.org/wiki/Causes_of_the_United_States_housing_bubble)

How has the Housing Bubble effected the Economy?

The impacts to the economy due to the housing crisis is far reaching. People in construction lost their jobs,states and local communities are struggling due to decreased property taxes and loss of jobs and thus impacting income tax collected. Banks are struggling or going bankrupt because of the mortgage crisis. Homeowners have watched their assets shrink or disappear completely. Experts predict it could take years to fully recover from the losses incurred. One of the major impacts was the foreclosures and what it did to consumer credit and the mortgage industry. In response to this crisis, the Housing and Economic Recovery Act (HERA) of 2008 was enacted. “It authorized the Federal Housing Administration to guarantee up to $300 billion in new 30-year fixed rate mortgages for subprime borrowers if lenders write-down principal loan balances to 90 percent of current appraisal value. It was intended to restore confidence in Fannie Mae and Freddie Mac by strengthening regulations and injecting capital into the two large U.S. suppliers of mortgage funding.” (http://en.wikipedia.org/wiki/Housing_and_Economic_Recovery_Act_of_2008) It also created a first time home buyer tax credit to encourage buying. (http://www.hud.gov/news/recoveryactfaq.cfm)

In closing, while the housing crisis wasn’t as devastating as the Great Depression, it has been the most significant economic crisis in our lifetime. It has reached everyone, homeowner or not. It will have lasting impacts but it has taught us lessons, hopefully ones that everyone learns from.

Download this page in PDF format

Download this page in PDF format